Universal Pension: How to Apply From Online

You want to know Universal Pension: How to Apply From Online? The government is launching a universal pension program (scheme) to bring the citizens of the country under the pension system. Prime Minister Sheikh Hasina inaugurated this much awaited program on Thursday morning. As a result, the universal pension program is open to all from today.

A contributor will get lifetime pension benefits from the age of 60 years if he joins the pension program or scheme. But if the contributor dies, his nominee or heir will get the pension. However, in this case, the nominee can withdraw the pension till the age of 75 years of the contributor.

Currently four types of schemes have been introduced under the universal pension. Among them there are Pravas scheme for expatriates, Pragati scheme for private employees, Protection scheme for citizens engaged in informal sector i.e. self-employed and Samata scheme for low income people.

Public Pension Scheme Regulations have already been issued to implement these programmes; And Public Pension Authority has been formed. Besides, a website named ‘Upension‘ has been launched. Anyone can join the pension program from today through this website.

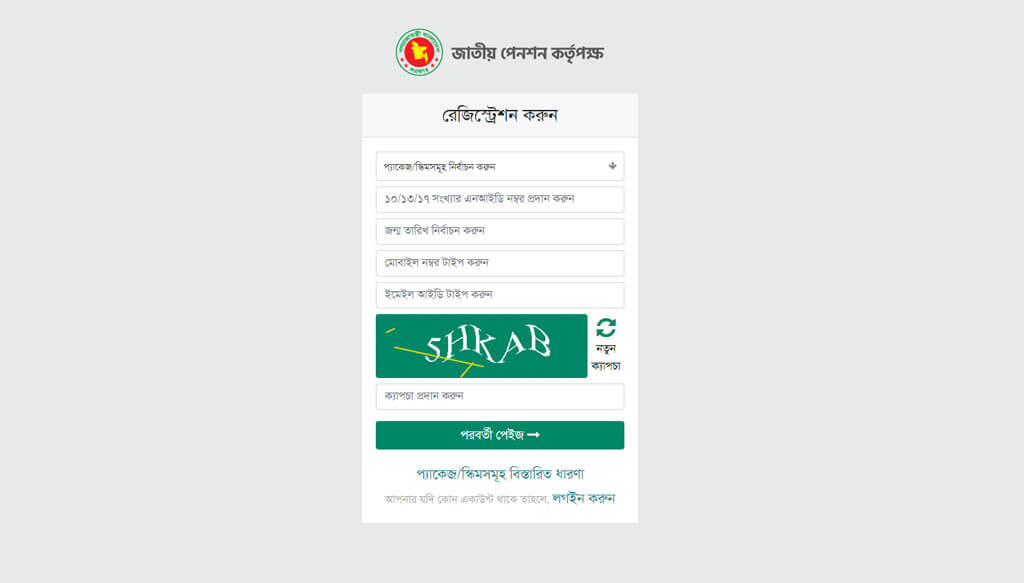

Universal Pension: How to Apply From Online

- Vist Official Website

- Click Registration

- Fill all Process

Important Information for Universal Pension

- Anyone can nominate one or more people if they want.

- In addition to the monthly subscription, one can pay the full subscription every three months or once a year.

- In case of failure to pay the subscription within the due date, the subscription can be paid without penalty till the next month. 1% late fee will be added for every day thereafter.

- If one does not pay 3 installments in a row, his account will be suspended. However, if one declares himself insolvent, the account will not be suspended even if the contribution is not paid for up to 12 months.

- Subscription can be paid online and through any mobile banking service.

Probash

This is only for Bangladeshi citizens working or staying abroad. Its monthly subscription rate has been fixed at 5 thousand, 7.5 thousand and 10 thousand taka. If the person wants, he can pay the amount equivalent to this contribution in the currency of the country he is in. You can also pay in local currency when you come back to the country. Besides, if necessary, there is an opportunity to change the immigration scheme.

Progoti

This scheme is for the employees of private companies. In this case too, the subscription rate has been divided into three parts. Anyone can participate in this scheme by paying 2 thousand, 3 thousand or 5 thousand rupees per month.

Again the organization or the owner of the organization can also participate in the Pragati scheme. In that case, half of the total contribution will be borne by the employee and the other half by the institution.

Surokha

This scheme is for self dependent person. That is, someone who is not employed anywhere but can earn himself, they can participate in the protection scheme. Freelancers, farmers, laborers etc. come under this. There are four types of subscription rates in this scheme – 1000, 2000, 3000 and 5000 taka per month.

Somota

The subscription rate in this scheme is one – one thousand rupees. However, in this case, the individual will pay five hundred taka per month and the remaining five hundred will be given by the government. This scheme is mainly for low income people living below poverty line.

In this case, Bangladesh Bureau of Statistics will determine the poverty line. For example, only those whose annual income is now between 60 thousand rupees per annum will be included in this scheme.

Who is this scheme for?

The National Pension Authority says that this pension system has been introduced to benefit all the people of the country. In particular, the aging population is increasing due to the increase in average life expectancy. As a result, their social security will be provided by the universal pension system.

Bangladeshi citizens of all professions between the ages of 18 to 50 can participate in this scheme according to their National Identity Card. In other words, national identity card is required to be a part of public pension scheme.

However, there is an exception for expatriate Bangladeshis, who do not have a national identity card, they can register with a passport if they want, but in that case, the national identity card must be collected and submitted as soon as possible.

Again, special consideration has been given in terms of age. Those who have crossed the age of 50 can also participate in the universal pension scheme. But in that case he will get pension after 10 consecutive years of contribution.

That is, according to the scheme, the person will start getting pension from the government only when he is 60 years old, he will not have to pay any more contribution. But if one reaches the age of 55 and participates in the scheme then he will start getting pension from the age of 65.

The government has announced a total of 6 schemes. However, four schemes have been launched for now. These are named immigration, progress, protection and equality.